The Affordable Housing Data Portal provides access to two different sources of data on affordable rental housing (apartments) in Washington State:

The Washington State Housing Finance Commission’s database of housing financed by the federal Low Income Housing Tax Credit and tax-exempt bonds. You can visualize this data on a map of Washington or download the entire data set.

Data includes:

- Project address, type of construction, developer and developer type

- Project costs and sources of financing

- Number of units, size of units, income limits and other unit restrictions

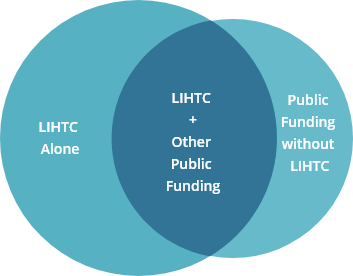

Funding sources of units in AHDP

Web-Based Annual Reporting System (WBARS) WBARS is used by most of the public funders of this housing in Washington state. It includes Low

Income Housing Tax Credit properties as well as multifamily properties with other kinds of public funding, such as the state Housing Trust Fund,

federal HOME funds, and regional government or levy dollars. It is used by the organizations and companies that manage these properties. You can

download the entire data set.

Data includes some of the above-mentioned fields, as well as the owner and property manager of the property.Please note: Each funding source is

represented by a separate row, so if the property has more than one funding source, you will find multiple rows for that property.

The Low Income Housing Tax Credit (LIHTC) program provides federal tax

credits that housing developers sell to investors in return for equity to build

their project. These credits are allocated by housing finance agencies (like the

Commission) in each state. The affordable apartments built using the LIHTC

must remain rent- and income-restricted, often with additional restrictions,

for several decades.

The housing credit finances affordable apartments for many kinds of people. Apartments can be set aside for people earning up to 60% of area median income; many are set at 30% or 50% of area median income. They can also be set aside for people experiencing homelessness, people with disabilities, seniors, farmworkers, or large households.

The housing credit finances affordable apartments for many kinds of people. Apartments can be set aside for people earning up to 60% of area median

income; many are set at 30% or 50% of area median income. They can also be set aside for people experiencing homelessness, people with disabilities,

seniors, farmworkers, or large households.

As a result, LIHTC properties vary greatly in the residents and communities they serve. They are found in urban, suburban and rural areas; some serve

particular populations such as the homeless or seniors, while others have large multi-bedroom units for families. Some are owned and operated by

for-profit businesses, some by non-profit organizations, housing authorities or tribes. What they have in common is income and rent restrictions, as well

as requirements to remain safe and reliable homes.

For more information about the LIHTC and how it is allocated in Washington state, visit the Commission’s Multifamily Housing page.

These tax-exempt bonds, issued by the Commission, mostly finance

housing for seniors in retirement communities, including independent

apartments, assisted living and nursing beds. Learn more at the

Commission’s Nonprofit Housing page.